Which of the following is NOT an advantage of a partnership?

A. Profits are subject to only personal taxation.

B. permits more effective specialization in occupations

C. limited liability

D. easy to form

Answer: C

You might also like to view...

When the initial and only deposit in the banking system is $1,000 and the legal reserve requirement is 20 percent, what is the total money in the economy assuming banks loan out the maximum?

a. $800 b. $1,000 c. $1,250 d. $2,000 e. $5,000

The Laffer curve illustrates that

A) there are two tax rates at which zero tax revenues are raised. B) a decrease in tax rates can cause an increase in tax revenues. C) an increase in tax rates can cause an increase in tax revenues. D) an increase in tax rates can cause a decrease in tax revenues. E) all of the above

The market clearing price of corn has just increased. Which of the following could have caused this change?

A. a reduction in demand B. an increase in quantity demanded C. a reduction in supply D. an increase in quantity supplied

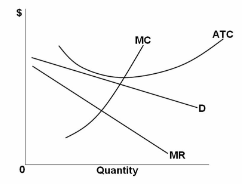

The monopolistically competitive firm shown in the figure:

A. is in long-run equilibrium.

B. might realize an economic profit or a loss, depending on its choice of output level.

C. cannot operate profitably in the short run.

D. can realize an economic profit.