In September of 2000, the Federal Reserve Bank of New York sold dollars in exchange for euro. To keep the federal funds rate on target, the Open Market desk:

A. bought dollars.

B. bought U.S. Treasury bonds.

C. sold dollars.

D. sold U.S. Treasury bonds.

Answer: D

You might also like to view...

Refer to Goods X and Y. The relative price of good X in terms of good Y is always equal to

Assume that good X is on the horizontal axis and good Y is on the vertical axis in the consumer-choice diagram. PX denotes the price of good X, PY is the price of good Y, and I is the consumer's income. Unless otherwise stated, the consumer's preferences are assumed to satisfy the standard assumptions. a. the magnitude of the slope of the budget line. b. the marginal value of X in terms of Y. c. the horizontal intercept of the budget line. d. the vertical intercept of the budget line.

Suppose the production possibilities for two countries, producing either food or clothing, are shown in the above figure. They can each produce any linear combination as well

Measuring food on the horizontal axis, the joint production possibility frontier has a horizontal intercept of A) 10. B) 20. C) 30. D) 50.

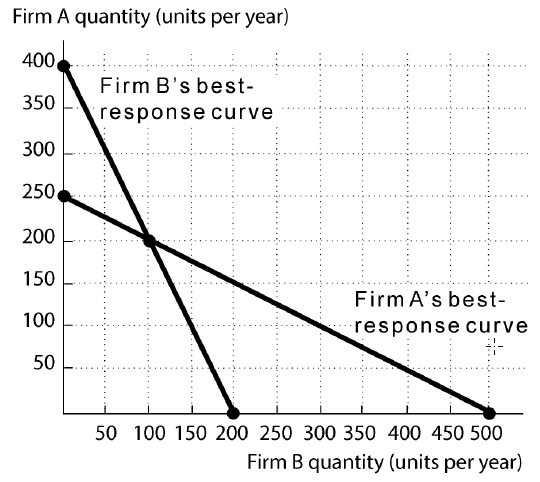

Two firms, A and B, are in the market and barriers to entry keep other firms from entering. The managers are involved in a Cournot oligopoly and the figure shows the best response curves for the two firms . In the Cournot equilibrium, Firm A produces ________ units per year and Firm B produces ________ units per year.

A) 250; 200 B) 400; 200 C) 250; 500 D) 200; 100

Savings bonds differ from most other bonds in that-

What will be an ideal response?