The transfer price that should be used by top management in evaluating whether a division should buy within the company or from an outside supplier is the:

A. transfer price based on variable cost.

B. transfer price based on an open market price.

C. negotiated transfer price.

D. transfer price based on full cost.

Answer: B

You might also like to view...

Which of the following statements is CORRECT?

A. WACC calculations should be based on the before-tax costs of all the individual capital components. B. Flotation costs associated with issuing new common stock normally reduce the WACC. C. If a company's tax rate increases, then, all else equal, its weighted average cost of capital will decline. D. An increase in the risk-free rate will normally lower the marginal costs of both debt and equity financing. E. A change in a company's target capital structure cannot affect its WACC.

Phips Co. purchases 100 percent of Sips Company on January 1, 20X2, when Phips' retained earnings balance is $320,000 and Sips' is $120,000. During 20X2, Sips reports $20,000 of net income and declares $8,000 of dividends. Phips reports $125,000 of separate operating earnings plus $20,000 of equity-method income from its 100 percent interest in Sips; Phips declares dividends of $35,000.Based on the preceding information, what is Sips' post-closing retained earnings balance on December 31, 20X2?

A. $132,000 B. $108,000 C. $140,000 D. $120,000

The effect that business recessions and prosperity have on time series values is an example of the disaster component of a time series

Indicate whether the statement is true or false

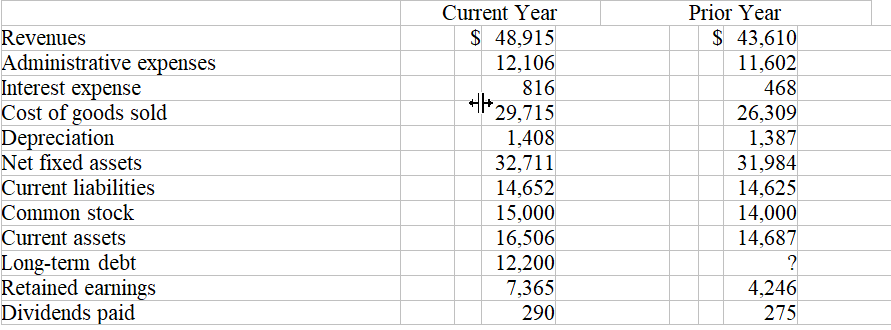

What is the cash flow of the firm for the current year if the tax rate is 22 percent?

Ledger Properties has the following financial information:

A) $1,885

B) $1,042

C) $2,297

D) $2,096

E) $2,517