Federal tax and expenditure programs:

A. are not effective means of redistributing income in the United States.

B. are somewhat effective means of redistributing income in the United States.

C. have worsened the inequality of income in the United States.

D. have dramatically equalized income in the United States.

Answer: B

You might also like to view...

China's current rate of GDP growth is quite rapid. Its current growth rate is probably three times that of the United States. However, the levels of pollution are much higher in China

Would you consider China to be better off than the United States given this information? Why or why not?

Which president had to cope with both rising deficits and a rising rate of inflation?

A. John Kennedy B. Dwight Eisenhower C. Jimmy Carter D. Ronald Reagan

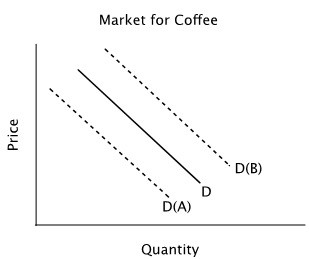

Refer to the accompanying figure. Suppose the solid line shows the current demand for coffee. In response to a news story explaining that coffee causes heart disease, you should expect:

A. neither a change in quantity demanded nor a shift in demand. B. the demand curve to shift to D(B) in anticipation of higher future prices. C. the demand curve to shift to D(A) because some people will stop drinking coffee. D. the quantity of coffee demanded to decrease, but no shift in the demand curve.

A country that has absolute advantage in producing all goods does not benefit from trade.

a. true b. false