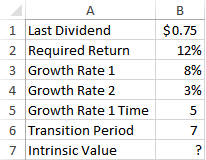

The last dividend payment of a stock was $0.75 and this dividend is expected to grow at 8% per year for three years. After that, the dividend will grow at 3% indefinitely. Assume that the transition between 8% and 3% will be gradual rather than instantaneous. The transition period is 3 years. Using the H-Model, what is the correct formula for B7 if the required rate of return on this stock is 12%?

a) =B1/(B2-B4*(1+B4+B5+B5+B6)/2*(B3-B4))

b) =(B1/(B2-B4)*(1+B4+(B5+B6)/2*(B3-B4)))

c) =(B1/(B2+B4)*(1-B4-(B5-B5-B6)/2*(B3+B4)))

d) =(B1/(B2-B3)*(1+B2+(B5+B5+B6)/2*(B4-B3)))

e) =(B1/(B2-B4)*(1+B4+(B5+B5+B6)/2*(B3-B4)))

e) =(B1/(B2-B4)*(1+B4+(B5+B5+B6)/2*(B3-B4)))

You might also like to view...

Cloud computing

a. pools resources to meet the needs of multiple client firms b. allows clients to expand and contract services almost instantly c. both a. and b. d. neither a. not b.

An inventory turnover ratio of 8.5 times indicates that:

A. the inventory of the firm turns over every 8.5 days. B. the value of the inventory of the firm is 8.5 percent of the total assets of the firm. C. the value of sales of the firm is 8.5 times the cost of goods sold. D. the firm will restock its inventory every 42.35 days. E. the firm pays for its inventory once in 42.35 days.

Data can flow over a circuit in three ways: ________, half-duplex, or full-duplex

A) uniplex B) simplex C) omniplex D) eruplex

Operating cash flow will increase with a decrease in

A) inventories. B) current liabilities. C) depreciation expense. D) capital expenditures.