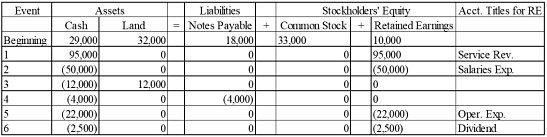

At the beginning of Year 2, the accounting records of Grace Company included the accounts and balances shown on the first row of the table below. During Year 2, the following transactions occurred:1. Received $95,000 cash for providing services to customers2. Paid salaries expense, $50,0003. Purchased land for $12,000 cash4. Paid $4,000 on note payable5. Paid operating expenses, $22,0006. Paid cash dividend, $2,500Required:a) Record the transactions in the appropriate accounts. Record the amounts of revenue, expense, and dividends in the retained earnings column. Enter 0 for items not affected. Provide appropriate titles for these accounts in the last column of the table. (The effects of the first event are shown below.)

alt="" style="vertical-align: 0.0px;" height="220" width="582" />b) What is the amount of total assets as of December 31, Year 2?c) What is the amount of total stockholders' equity as of December 31, Year 2?

What will be an ideal response?

a)

b) Total assets = $33,500 + $44,000 = $77,500

c) Total stockholders' equity = $33,000 + $30,500 = $63,500

You might also like to view...

Which of the following is true about a motion?

a. After the jury has returned a verdict, the defendant cannot file motions to have the verdict set aside. b. The motion is usually an objection to the plaintiff's complaint that points out defects of the case and asks for a specific remedy. c. A defendant may file a motion for summary judgment only after a case goes to trial. d. The motion explains the alleged violation of the law and the monetary expenses or damages sought in the case.

Which of the following is NOT true regarding specific performance?

a. It will not be granted if money damages would be adequate to compensate the injured party. b. It is granted in contracts involving unique items of personal property. c. It will be granted frequently in contracts involving the sale of goods. d. The courts will not order directly the specific enforcement of contracts for personal services.

Problems with infeasible solutions arise in practice because

A. management doesn't specify enough restrictions. B. too many restrictions have been placed on the problem. C. of errors in objective function formulation. D. there are too few decision variables.

A sales allowance is recorded as a debit to Accounts Receivable and a credit to Sales Allowances.

Answer the following statement true (T) or false (F)