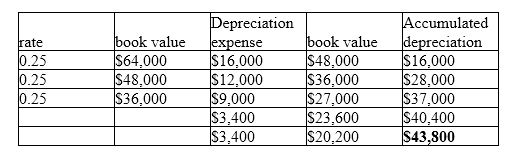

Renoir associates purchased a vehicle for $64,000, with an estimated useful life of 8 years and a salvage value of $10,000. The company uses the double-declining-balance method of depreciation; however, after year 3 they switch to the straight-line method. There is no change to the estimated useful life or salvage value. What is the accumulated depreciation balance at the end of year 5 (round to

the nearest dollar)? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $40,400

B) $43,800

C) $48,333

D) $43,750

B) $43,800

Explanation: 1: 2/useful life × book value at beginning of year = depreciation expense; step 2: 2/useful life × (price - year 1 depreciation) = depreciation year 2; step 3: 2/useful life × (book value - depreciation year 2); step 4: (book value - salvage value)/remaining useful life = depreciation years 4 and 5; step 5: add together all accumulated depreciation.

You might also like to view...

Which of the following would not be an example of nonverbal communication?

A) Space B) Dress C) Facial expression D) Jargon E) Vocal inflection

After a couple of years of successful business, an experimental theatre company based in Aurora is unable to sell tickets for its theatre shows. They have been using profits from previous shows to run the business

The company is in the ________ phase of its life cycle. A) maturity B) obsolescence C) introduction D) growth E) decline

Cash flows from investing activities, as part of the statement of cash flows, include receipts from the sale of land

Indicate whether the statement is true or false

Lindsay plans to give her audience a handout with images of her PowerPoint slides. Lindsay should distribute this handout after her presentation to maintain audience control

Indicate whether the statement is true or false