The firm's annual financing costs of the aggressive financing strategy are ________. (See Table Below)

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

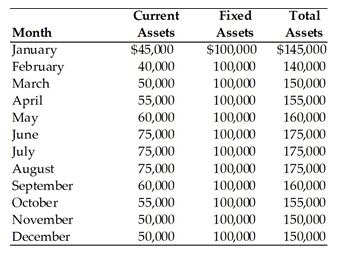

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

A) $21,175

B) $26,075

C) $24,475

D) $22,775

B) $26,075

You might also like to view...

Online focus group participants don't have the potential to be distracted by external stimuli

Indicate whether the statement is true or false

A laser printer is able to operate 400 hr between two repairs, and the mean time to repair the printer is 4 hr. Compute and indicate the availability of the printer.

A. 0.99 B. 0.96 C. 0.98 D. 0.97

The Aston researchers identified five variables drawn from Max Weber’s initial list of fifteen: __________ refers to the extent to which the organization uses manuals of organizational procedures.

a. Formalization b. Centralization c. Specialization d. Standardization

Being a negative role model for others is part of being a nurturing, positive person because you demonstrate to others how not to behave

Indicate whether the statement is true or false.