During December Year 2, Crowe Company sold 125 units @ $225 each. Cash selling and administrative expenses for the year were $11,000. All transactions were cash transactions. The following information is also available:Beginning inventory60 units @ $100April 18 purchase90 units @ $115August 5 purchase30 units @ 120The company's income tax rate is 30%.Required:a) Prepare an income statement for Crowe Company for Year 2 assuming:1) FIFO inventory cost flow2) LIFO inventory cost flowb) Prepare the operating activities section of the statement of cash flows for Year 2 assuming:1) FIFO inventory cost flow2) LIFO inventory cost flow

What will be an ideal response?

a) 1)

| FIFO |

| Income Statement |

| For the Year Ended December 31, Year 2 |

| Sales (125 @ $225) | $ 28,125 |

| Cost of goods sold | 13,475 |

| Gross margin | 14,650 |

| Selling and administrative expense | 11,000 |

| Net income before taxes | 3,650 |

| Income tax expense | 1,095 |

| Net income | $ 2,555 |

2)

| LIFO |

| Income Statement |

| For the Year Ended December 31, Year 2 |

| Sales (125 @ $225) | $ 28,125 |

| Cost of goods sold | 14,450 |

| Gross margin | 13,675 |

| Selling and administrative expense | 11,000 |

| Net income before taxes | 2,675 |

| Income tax expense | 803 |

| Net income | $ 1,872 |

b)

1) FIFO

| FIFO |

| Cash Flow from Operating Activities |

| Cash received from sales | $ 28,125 |

| Cash payment for inventory | (13,950) |

| Cash payment for selling and administrative expense | (11,000) |

| Cash payment for income tax expense | (1,095) |

| Net cash flow from operating activities | $ 2,080 |

2) LIFO

| LIFO |

| Cash Flow from Operating Activities |

| Cash received from sales | $ 28,125 |

| Cash payment for inventory | (13,950) |

| Cash payment for selling and administrative expense | (11,000) |

| Cash payment for income tax expense | (803) |

| Net cash flow from operating activities | $ 2,372 |

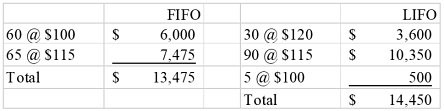

Cost of goods sold:

Business

You might also like to view...

What affects approximately 13 percent of U.S. workers and costs an estimated $23.8 billion annually?

a. poor customer-employee relationships b. pressure to lie c. employee theft d. abusive supervision

Business

Planning is less important for a report addressed to employees than for one addressed to a customer

Indicate whether the statement is true or false

Business

Sally saves her files using OpenOffice. What is the name of her file?

A. TeamDoc.xls B. TeamDoc.docx C. TeamDoc.drp D. TeamDoc.zip E. TeamDoc.odt

Business

Making program changes, correcting errors in the programs, and adding enhancements to the programs is called systems ______________________________. ?

Fill in the blank(s) with the appropriate word(s).

Business