How does the imposition of an excise tax on a good affect its market equilibrium?

A) Equilibrium quantity decreases, and equilibrium price decreases.

B) Equilibrium quantity decreases, and equilibrium price increases.

C) Equilibrium quantity increases, and equilibrium price decreases.

D) Equilibrium quantity increases, and equilibrium price increases.

Answer: B

You might also like to view...

Consider a situation in which the government has limited information about costs and benefits of pollution abatement associated with a given industry

However, it is known that the marginal social cost curve for emissions is much steeper than the marginal cost of abatement curve (in absolute terms). In this situation, which method of emissions control is preferable when the greatest concern is with accuracy of control rather than the cost of control? That is, should a fee be used or should a standard be used? Explain.

Appendix: The Identification Problem in the development of a demand function is a result of:

a. the variance of the demand elasticity b. the consistency of quantity demanded at any given point c. the negative slope of the demand function d. the simultaneous relationship between the demand and supply functions e. none of the above

A decrease in demand for a good could mean that

a. consumers are willing to pay a higher price for each quantity of the good b. consumers are willing to buy larger quantities of the good at each price c. the demand curve has undergone a parallel shift to the right d. the demand curve has undergone a nonparallel shift to the right e. the demand curve has shifted to the left

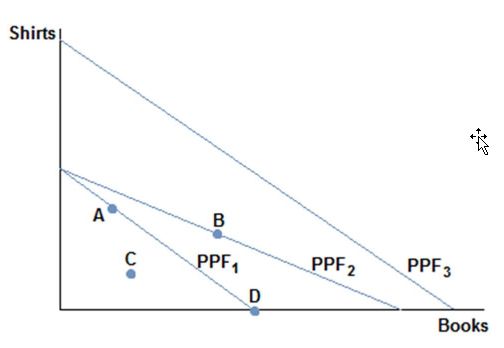

Consider a society facing the production possibilities curves in the figure shown. What is the most likely cause of a society moving from PPF3 to PPF1?

A. A tornado

B. More workers

C. A desire to read lessbooks

D. Better sewing technology