The information related to Outloud Music, Inc is given below

Year ended December Year ended December

31, 2016 31, 2017

Net Income $81,510 $210,570

Income Tax Expense 55,910 103,505

Interest Expense 6,595 59,505

Calculate the times-interest-earned ratio for each year and also state the percentage change in the ratio.

What will be an ideal response

December December

31, 2016 31, 2017

Net Income $ 81,510 $ 210,570

Income Tax Expense 55,910 103,505

Interest Expense 6,595 59,505

EBIT $ 144,015 $ 373,580

Times-interest-earned ratio (EBIT / Interest Expense) 21.84 6.28

Percentage Change [(21.84 - 6.28 ) / 21.84 x 100 ] -71.24%

You might also like to view...

The Samuel Company uses the straight-line method to depreciate its equipment. On May 1, 2015, the company purchased some equipment for $224,000. The equipment is estimated to have a useful life of ten years and a salvage value of $20,000. On December 31, 2015, how much depreciation expense should Samuel record for the equipment in the adjusting entry?

A) $20,400 B) $18,500 C) $13,600 D) $8,500

When MPR professionals offer a story to the media that is newsworthy, this means all of the following EXCEPT that

A) they have something worth covering. B) the story is objective and therefore interesting. C) the medium has an ulterior motive for publishing it. D) it tends to drive audiences to the medium covering the story. E) the story idea contains certain themes that hook audiences.

During the traditional communication process, a source does decoding and a receiver does encoding.

Answer the following statement true (T) or false (F)

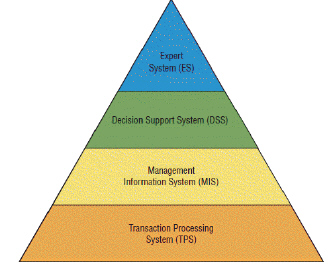

The figure above illustrates the level of ____ of the primary computer-based information systems discussed in this chapter.

The figure above illustrates the level of ____ of the primary computer-based information systems discussed in this chapter.

A. complexity B. intelligence C. workload D. all of the above