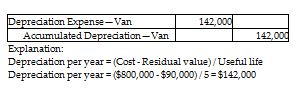

Hampton Company purchased a van on January 1, 2018, for $800,000. Estimated life of the van was five years, and its estimated residual value was $90,000. Hampton uses the straight-line method of depreciation. Prepare the journal entry to record the depreciation expense for 2018 on the van. Omit explanation.

What will be an ideal response?

You might also like to view...

The depreciable cost of a building is the same as its acquisition cost

a. True b. False Indicate whether the statement is true or false

Which of the following is a franchisor problem?

A. Attempts to require adherence to prices set by the franchisor may violate the Sherman Act. B. Insurance cannot be used to cover risks due to torts committed by the franchisee. C. The franchisee has to be made an employee of the franchisor. D. Attempts to require franchisees to buy products exclusively from the franchisor may violate the Sherman Act.

By harvesting its SBU, a company would most likely be ________

A) milking the SBU's short-term cash flow regardless of the long-term effect B) selling the SBU or phasing it out and using the resources elsewhere C) investing just enough to hold the SBU's current market share D) investing more in the business unit to build its share E) diversifying the company's product line

One way to empathize with the client's objection and turn objections into sales is to use the "feel-felt- ________" strategy

Fill in the blanks with correct word