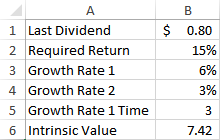

The last dividend payment of a stock was $0.80 and this dividend is expected to grow at 6% per year for three years. After that, the dividend will grow at 3% indefinitely. Using the two-stage dividend growth model, what is the correct formula for B6 if the required rate of return on this stock is 15%?

a) =B1*(1+B3)/(B2-B3)*(1-((1+B3)/(1+B2))^B5)+(B1*(1+B3)^B5*(1+B4)/(B2-B4)/(1+B2)^B5)

b) =B1/(B2-B3)*(1+((1+B3)/(1+B2))^B5)+(B1*(1+B3)^B5*(1+B4)/(B2-B4)/(1+B2)^B5)

c) =B1*(1+B3)/B2-B3*1-(1+B3)/(1+B2)^B5+B1*(1+B3)^B5*(1+B4)/(B2-B4)/(1+B2)^B5

d) =B1*(1-B3)/(B2+B3)*(1+((1-B3)/(1-B2))^B5)-(B1*(1-B3)^B5*(1-B4)/(B2+B4)/(1-B2)^B5)

e) =B1*(1+B3)/(B2-B3)*(1-((1+B2)/(1+B3))^B5)+(B1*(1+B4)^B5*(1+B3)/(B2-B3)/(1+B2)^B5)

a) =B1*(1+B3)/(B2-B3)*(1-((1+B3)/(1+B2))^B5)+(B1*(1+B3)^B5*(1+B4)/(B2-B4)/(1+B2)^B5)

You might also like to view...

The account Allowance for Uncollectible Accounts is classified as a(n)

a. contra account to Uncollectible Accounts Expense. b. expense. c. liability. d. contra account to Accounts Receivable.

The price–quality association and prestige pricing are two aspects of _____

a. competition-oriented pricing b. cost-oriented pricing c. psychological pricing d. odd pricing

The adjusted R2 adjusts R2 for:

a. non-linearity b. outliers c. low correlation d. the number of explanatory variables in a multiple regression model

To get the proper financial counseling, Marquis and Marta Jacobs made an appointment with Harry Hanstein. Harry has had two years of training in securities, insurance, taxation, retirement planning, and estate planning and has passed a rigorous qualifying examination given by the Certified Financial Planner Board of Standards in Denver. Which of the following most narrowly describes Harry's occupation?

A. Real estate broker B. Stockbroker C. Certified public accountant D. Tax consultant E. Certified financial planner