Your portfolio manager has suggested two high-yielding stocks: The Altria Group (MO) and Reynolds America (RAI). MO shares cost $50, yield 4.5% in dividends, and have a risk index of 2.0 per share. RAI shares cost $55, yield 5% in dividends, and have a risk index of 3.0 per share. You have up to $7,200 to invest and would like to earn at least $335 in dividends. How many shares (to the nearest whole number) of each stock should you purchase to meet your requirements and minimize the total risk index for your portfolio? What is the minimum total risk index?

?

A. buy 350 shares of MO and 40 shares of RAI for a minimum total risk index of 620

B. buy 190 shares of MO and 70 shares of RAI for a minimum total risk index of 310

C. buy 100 shares of MO and 40 shares of RAI for a minimum total risk index of 320

D. buy 260 shares of MO and 60 shares of RAI for a minimum total risk index of 600

E. no solution

Answer: C

You might also like to view...

An __________ triangle has two sides of equal length.

Fill in the blank(s) with the appropriate word(s).

Solve the problem.If f(x) = -6x + 5 and g(x) = 2x + 9, find g(f(x)).

A. 12x + 19 B. -12x + 59 C. -12x - 1 D. -12x + 19

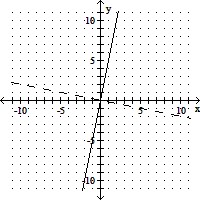

Graph the given function as a solid line (or curve) and its inverse as a dashed line (or curve) on the same set of axes.f(x) = 5x

A.

B.

C.

D.

Draw a tessellation of the plane using the given figure. If the figure does not tessellate the plane, state this.

What will be an ideal response?