The Congressional Budget Office projects that Social Security spending will rise from 5% of GDP to 6% over the next four decades. Why is that a problem?

What will be an ideal response?

The dependency ratio — the ratio of benefits-eligible retirees to contributing workers — has declined, due to improved longevity and a falling birth rate. Though the total of benefits to be paid is not rising rapidly, relative to GDP, the tax base is not growing fast enough to fund the existing system.

You might also like to view...

How is dollarization different from monetary union?

What will be an ideal response?

Asset-price bubbles ________

A) are a relatively recent phenomenon B) end with an increase in asset prices C) have been a feature of market economies for centuries D) are likely to be prevented by advances in computer technology and telecommunications

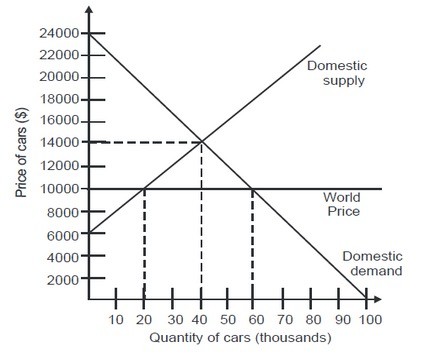

If this is an open economy, quantity supplied of cars by the domestic producers will be ________.

A. 20,000 B. 80,000 C. 60,000 D. 40,000

Which of the following equations shows how much X dollars will be worth if invested at an annual interest rate i for t years, if interest is compounded annually?

A. (1 + i) t X B. X/(1 + i) t C. (1 + X)i t D. (X + i)