A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

?

?

If a certain piece of equipment costs $4,100 and has a scrap value of $1,700 after 5 years, write an equation to represent the present value after t years.

?

A.

B.

C.

D.

E.

Answer: A

Mathematics

You might also like to view...

Solve for x: x2 + 3x - 10 = 0

a. x = -3, 10 b. x = 2, -5 c. x = 1.359, 7.359 d. x = -0.821, -5.180 e. x = 0.679, -3.680

Mathematics

Use the Change-of-Base Formula and a calculator to evaluate the logarithm. Round to four decimal places.log1020

A. 0.3010 B. 2.3010 C. 0.7686 D. 1.3010

Mathematics

Insert <, >, or = between the pair of numbers to make the statement true.

A. > B. = C. <

Mathematics

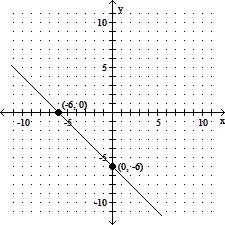

Find the slope of the line.

A. -6 B. -1 C. 6 D. 1

Mathematics