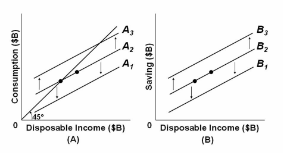

Refer to the above figures with consumption schedules in figure (A) and saving schedules in figure (B), which correspond to each other across different levels of disposable income. If, in figure (A), line A 2 shifts to A 3 because of the so-called wealth effect, then in figure (B) line:

A. B 2 will shift to B 3

B. B 1 will shift to B 2

C. B 2 will shift to B 1

D. B 3 will shift to B

C. B 2 will shift to B 1

You might also like to view...

A monopoly market is:

A. a market with many sellers. B. a market with a single seller. C. a market with a few sellers. D. a market with a single buyer.

If at the prevailing interest rate the quantity of money demanded is $2 trillion, and the supply of money is $1.5 trillion, then which of the following is true?

A. There is a shortage of money, and consequently interest rates must fall in order to achieve an equilibrium in the money market. B. There is a surplus of money, and consequently interest rates must fall in order to achieve an equilibrium in the money market. C. There is shortage of money, and consequently interest rates must rise in order to achieve an equilibrium in the money market. D. There is a surplus of money, and consequently interest rates must rise in order to achieve an equilibrium in the money market.

Suppose that the level of GDP increased by $100 billion in a private closed economy where the marginal propensity to consume is .5. Aggregate expenditures must have increased by:

A. $100 billion. B. $50 billion. C. $500 billion. D. $5 billion.

The Keynesian, Classical, and Intermediate ranges apply to the

A. slope of the individual market demand curve. B. slope of the aggregate demand curve. C. shape of the individual market supply curve. D. shape of the aggregate supply curve.