Which of the following statements is true?

A. Above the optimal tax rate, a reduction in tax rates along the downward-sloping portion of the Laffer curve would increase tax revenues.

B. According to supply-side fiscal policy, lower tax rates would shift the aggregate demand curve to the right, expanding the economy and creating some inflation.

C. The presence of the automatic stabilizers tends to destabilize the economy.

D. To combat inflation, Keynesians recommend lower taxes and greater government spending.

Answer: A

You might also like to view...

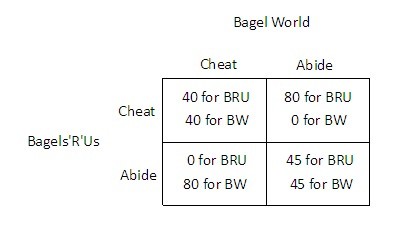

The market for bagels contains two firms: BagelWorld (BW) and Bagels'R'Us (BRU). The owners of the two firms decide to fix the price of bagels. The table below shows how each firm's profit (in dollars) depends on whether they abide by the agreement or cheat on the agreement.  For Bagels 'R' Us, ________ is a ________.

For Bagels 'R' Us, ________ is a ________.

A. abiding by the agreement; dominant strategy B. cheating on the agreement; dominant strategy C. cheating on the agreement; dominated strategy D. abiding by the agreement; dominant strategy when Bagel World also abides

Which of the following is considered contractionary fiscal policy?

A) The New Jersey legislature cuts highway spending to balance its budget. B) Legislation removes a college tuition deduction from federal income taxes. C) Congress increases the income tax rate. D) Congress increases defense spending.

Which of the following is the compound growth rate formula?

a. GDP at starting date × (1 + growth rate of GDP)years = GDP at end date b. GDP at starting date/(1 + growth rate of GDP)years = GDP at end date c. GDP at starting date ? GDP at end date = growth rate of GDPyears d. GDP at starting date × growth rate of GDPyears = GDP at end date

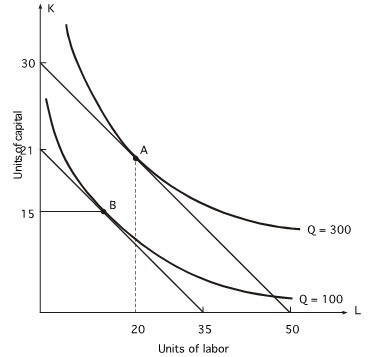

Refer to the following graph. The price of labor is $3 per unit: What is the price per unit of capital?

What is the price per unit of capital?

A. $2.00 B. $5.00 C. $1.50 D. $2.10