On July 1 . Toucan Corporation, a calendar-year company, received a condemnation award of $150,000 as compensation for the forced sale of a plant located on company property that stood in the path of a new highway. On this date, the plant building had a depreciated cost of $75,000 and the land cost was $25,000 . On October 1 . Toucan purchased a parcel of land for a new plant site at a cost of

$62,500 . Ignoring income taxes, Toucan should report in its income statement for the year ended December 31 a gain of

a. $0.

b. $12,500.

c. $37,500.

d. $50,000.

D

You might also like to view...

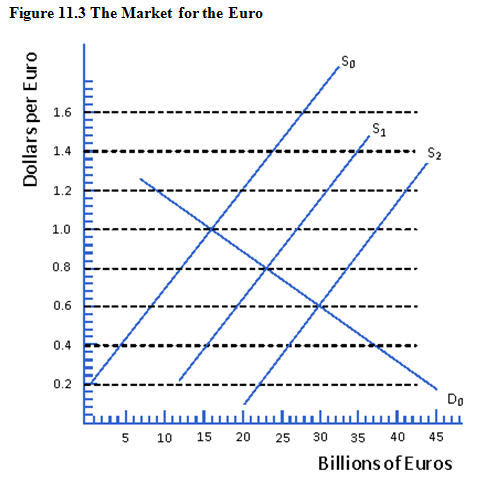

Refer to Figure 11.3. If the supply curve is represented by S0, then the equilibrium exchange rate is

a. $1.20.

b. $1.00.

c. $0.80.

d. $0.60.

The purpose of accounting is

A. assumed around the world to be the same. B. about to be codified in the process of convergence. C. to build an objective measure of a company's results. D. influenced by a country's culture.

The European Union includes all of the following except:

A. Coordinated foreign policies B. Capital mobility C. Common monetary and fiscal policies D. Common labor laws

What are some of the signs that a company lacks controls?

What will be an ideal response?