Suppose that, since the base year, all prices have risen by 100%. This year's current-dollar GDP is $2,000 billion. Then constant-dollar GDP is

A. $4,000 billion.

B. $3,000 billion.

C. $2,000 billion.

D.$1,000 billion.

E. $500 billion.

D.$1,000 billion.

You might also like to view...

Suppose the CPI for this year is 133.7. This number means that

A) on average, goods cost $133.70 each this year. B) prices rose 33.7 percent over the last year. C) prices rose 133.7 percent over the base year. D) prices rose 33.7 percent over the base year. E) prices rose 133.7 percent over the last year.

Consider the demand curves for soft drinks shown in the figure above. Moving from point a to point c means that

A) the marginal benefit of each additional soft drink falls. B) the opportunity cost of another soft drink increases. C) people's incomes have decreased. D) the price of a soft drink has increased.

Monetarists blame rising government deficits for rising inflation

A) because deficits shift aggregate demand to the right. B) so long as the aggregate supply curve is vertical. C) when financing these deficits involves money creation. D) because the deficits increase the demand for money and thus interest rates.

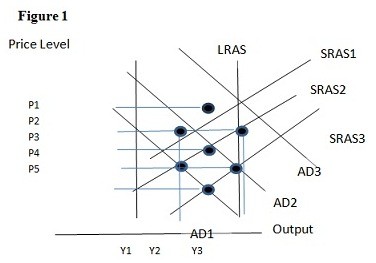

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.