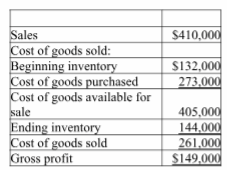

Hull Company reported the following income statement information for the current year:

The beginning inventory balance is correct. However, the ending inventory figure was overstated by $20,000. Given this information, the correct gross profit would be:

A) $149,000.

B) $169,000.

C) $129,000.

D) $142,000.

E) $112,000.

C) $129,000.

Explanation: If ending inventory of $144,000 was overstated by $20,000, the correct amount of ending inventory was $124,000. As a result, cost of goods sold was not $261,000 as reported, but rather $281,000. Thus, gross profit was $129,000 (Sales of $410,000 ? Cost of Goods Sold of $281,000).

You might also like to view...

Proceeds from borrowing money through a mortgage is an example of an investing activity

a. True b. False Indicate whether the statement is true or false

In a marketing planning process, after setting the objectives for the market plan, the next step is

to ________. A) execute the plan's strategy B) monitor key marketing metrics C) enable contingency plans if things go wrong D) determine profitable opportunities in the market

A ________ groups cost by behavior; costs are classified as either variable costs or fixed costs

A) balance sheet B) contribution margin income statement C) traditional income statement D) absorption costing income statement

All of the following statements about aviation insurance are true EXCEPT

A) Physical damage coverage can be written on an "all-risks" basis. B) Liability coverage also applies to bodily injury arising out of the premises where the aircraft is stored. C) Liability coverage applies to liability arising out of a workers compensation law. D) Aviation insurance is a highly-specialized market with relatively few insurers.