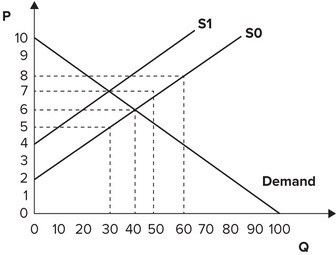

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $6 and a quantity of 40 units. If the government imposes a $2 per-unit tax on this product, consumer surplus will fall from:

A. 80 to 45.

B. 160 to 80.

C. 90 to 45.

D. 160 to 90.

Answer: A

You might also like to view...

Expansionary fiscal policy will

A) shift the aggregate demand curve to the left. B) shift the aggregate demand curve to the right. C) shift the short-run aggregate supply curve to the left. D) not shift the aggregate demand curve.

If the cost of labor increases, the isocost line will

A) stay the same. B) shift outward in parallel fashion. C) rotate inward around the point where only capital is employed in production. D) shift inward in parallel fashion.

How does a pollution tax work?

What will be an ideal response?

The federal funds rate is the interest rate that _______ charge(s) _______

A. banks; other banks B. the Fed; commercial banks C. banks; their best corporate customers D. banks; on federal student loans