When Congress passed a law that imposed a tax designed to fund its Social Security and Medicare programs it wanted employers and workers to share the burden of the tax equally

Most economists who have studied the incidence of the tax have concluded

A) the tax rate should be greater for high-income workers than for low-income workers.

B) the burden of the tax falls almost entirely on workers.

C) the tax is not high enough to cover the future costs of Social Security and Medicare.

D) the tax on employers is too high because it reduces the employment of low-skilled workers.

B

You might also like to view...

When there is an expansionary gap, inflation will ________, in response to which the Federal Reserve will ________ real interest rates, and output will ________.

A. decline; lower; expand B. increase; raise; decline C. decline; lower; decline D. decline; raise; decline

In the above figure, which point represents an attainable but inefficient production point?

A) point C B) point N C) point L D) point D

Generally, which of the following is the most common reason why countries that experienced a financial crisis could not maintain their fixed exchange rate?

a. They were exporting too many commodities. b. The rates they had established were not in accordance with directives from the IMF. c. The exchange rate parities established were inconsistent with their corresponding macroeconomic policies. d. The general public refused to participate. e. The parities established made their currencies undervalued.

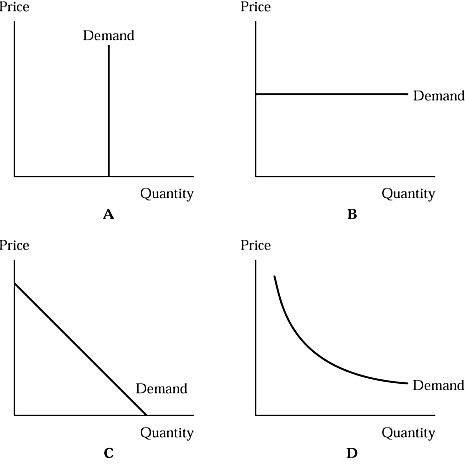

In Figure 4.1, the demand curve that has a zero elasticity is show in graph:

In Figure 4.1, the demand curve that has a zero elasticity is show in graph:

A. A. B. B. C. C. D. D.