Angela is a tenant of Bruce. On March 1, Angela paid Bruce $2,400 for 3 months of rent. On March 31, Angela's adjusting entries will include one with a debit to:

A. Prepaid Rent for $2,400 and a credit to Cash for $2,400.

B. Prepaid Rent for $800 and a credit to Rent Expense for $800.

C. Rent Expense for $2,400 and a credit to Prepaid Rent for $2,400.

D. Rent Expense for $800 and a credit to Prepaid Rent for $800.

Answer: D

You might also like to view...

In an organization, a supervisor usually makes the final employee selection decision.

Answer the following statement true (T) or false (F)

The Valor Company manufactures two products: L and M. The costs and revenues are as follows: Product L Product MSales price$150 $112 Variable cost per unit 90 68 Machine hours per unit 15 10 Total demand for Product L is 2,000 units and for Product M is 1,000 units. Machine time is a scarce resource. During the year, 36,000 machine hours are available.Required:a. How many units of Products L and M should Valor produce?

What will be an ideal response?

If a contract requires the seller to deliver the goods to a carrier at a named place, who will then carry the goods to the buyer, the risk of loss passes to the buyer ________

A. when the goods leave the warehouse of the seller B. as soon as he/she accepts the contract in writing C. when the goods are handed over to the carrier at that place D. at the time the contract is concluded

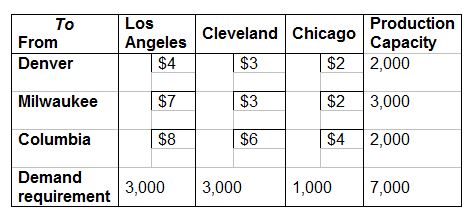

Determine the initial shipping cost using the matrix least cost method.

XYZ has three supply chain locations with respective production capacities of an electronic component (Denver, Milwaukee, and Columbia) and three demand locations with their respective demand requirements for that electronic component. The demand requirements, production capacities, and the per-unit transportation costs are tabled in the transportation matrix shown here.

A. $30,000

B. $40,000

C. $24,000

D. $31,000