What are derivatives and derivative markets? Explain with an example

Derivatives are financial instruments whose value is derived from an underlying asset. People might enter into forward contracts that fix the price today for delivery of a good at some date in the future. The buyer of the forward contract is "long"—committed to take delivery—and the seller is "short"—committed to deliver it. There is no requirement that the seller actually own the commodity or that the buyer have the necessary cash to pay for it when they make the original agreement. The value of future delivery in a forward contract depends on the market price of the commodity. (The commodity is usually called the "underlying".) Because its value depends on the price of the underlying, the forward contract is an example of a derivative or a derivative asset. A futures contract is a standardized forward contract, traded on a futures exchange. Like a forward contract, it sets a price today for future delivery.

As an example, the New York Mercantile Exchange (NYMEX) contract in natural gas specifies its product not by volume but by its heat content. A contract is for 10 thousand million British thermal units (or 10,000 mmbtu, roughly 10 million cubic feet) of gas, to be delivered at the Henry Hub, a pipeline junction in southern Louisiana. It is to flow at as uniform a rate as possible over the month specified in the contract. Contracts are possible for deliveries in every month over the next six years. The contract is valuable to both producers and large consumers of gas as a hedge that lessens the risks associated with the highly unstable ("volatile") spot price. The prime use of the gas contract is as a hedge, and fewer than three percent of such contracts go to delivery in most months. The remainder are settled in cash through the exchange, which acts as a counterparty for buyers and sellers to eliminate the risk of nonperformance.

You might also like to view...

When the government's outlays exceed its tax revenues, the national debt

A) shrinks thanks to the budget surplus. B) grows to finance the budget deficit. C) grows to finance the budget surplus. D) shrinks thanks to the budget deficit. E) does not change because it has nothing to do with government outlays and tax revenue.

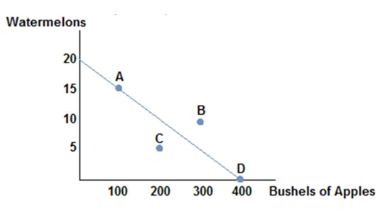

Consider the production possibilities frontier displayed in the figure shown. Which of the following combinations could not be produced?

A. (20 watermelons, 400 bushels of apples)

B. (15 watermelons, 100 bushels of apples)

C. (10 watermelons, 150 bushels of apples)

D. (0 watermelons, 400 bushels of apples)

The supply-side policies of the Reagan and Bush administrations led to high levels of

A. budget surpluses. B. unemployment. C. inflation. D. budget deficits.

A. there is a gap in the marginal revenue curve within which changes in marginal cost will not affect output or price. B. demand is inelastic above and elastic below the going price. C. the model assumes firms are engaging in some form of

collusion. D. the associated marginal revenue curve is perfectly elastic at the going price. A. demand curve will be less elastic than if the other oligopolists matched X's price changes. B. demand curve will be more elastic than if the other oligopolists matched X's price changes. C. marginal revenue curve will have a vertical gap. D. demand and marginal revenue curves will coincide.