A nation's average annual real GDP growth rate is 5%. Based on the "rule of 72," the approximate number of years that it would take for this nation's real GDP to double is

A. 14.4 years.

B. 12.5 years.

C. 10 years.

D. 16.2 years.

Answer: A

You might also like to view...

Which of the following assets is the most liquid?

a. Money. b. Gold. c. Land. d. Stocks.

A depreciation of the U.S. dollar will benefit the _____. a. countries exporting to the U.S

b. Australian firms selling in the U.S. c. U.S firms selling in Europe d. Japanese investors who have invested money in the U.S.

A monopoly is the single supplier of a product with no ______.

a. established price b. limit to supply c. barriers to entry d. close substitutes

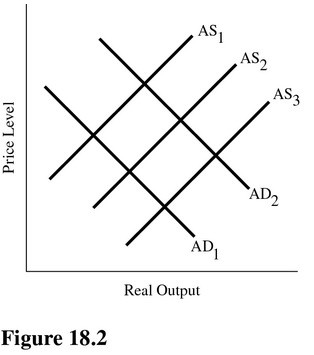

Refer to Figure 18.2. The sale of bonds by the Fed in the open market will result in

Refer to Figure 18.2. The sale of bonds by the Fed in the open market will result in

A. An increase in the money supply and a move from AS1 to AS2. B. A decrease in the money supply and a move from AD2 to AD1. C. An increase in the money supply and a move from AD1 to AD2. D. A decrease in the money supply and a move from AS2 to AS1.