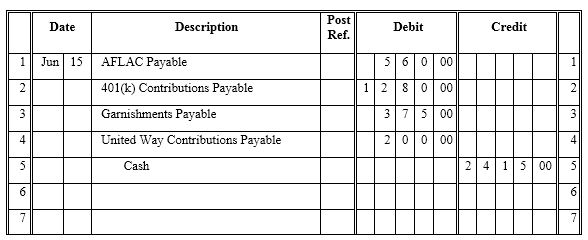

Sophie Sue Breeders has the following voluntary withholdings to remit:

AFLAC payable: $560.00

401(k) payable: $1,280.00

Garnishments payable: $375.00

United Way contributions payable: $200.00

Create the General Journal entry on June 15, 2017, for the remittance of these withheld amounts.

What will be an ideal response?

You might also like to view...

Which of the following stock investments should be accounted for using the cost method?

a. investments of less than 20% b. investments between 20% and 50% c. investments of less than 20% and investments between 20% and 50% d. all stock investments should be accounted for using the cost method

Which of the following best describes horizontal analysis?

A) comparing financial statement line items from year to year for the same company B) expressing each financial statement amount as a percentage of a budgeted amount C) comparing a company's financial statements with other companies D) calculating key ratios to evaluate performance

Total assets turnover reflects the effects of turnover ratios for accounts receivable, inventory, and fixed assets

Indicate whether the statement is true or false

Which of the following are not factors in the success of joint ventures according to the text?

A. Symmetry and reasonable expectations B. Finance and education C. Chemistry and symmetry D. Timing and chemistry