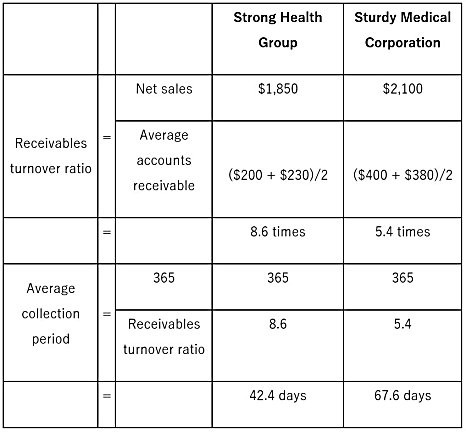

Selected financial data for Strong Health Group and Sturdy Medical Corporation, two companies in the health-care industry, are as follows:($ in millions)Net SalesBeginning AccountsReceivableEnding AccountsReceivableStrong Health$1,850$200$230Sturdy Medical2,100400380Required:1. Calculate the receivables turnover ratio and average collection period for Strong Health and Sturdy Medical. Round your answers to one decimal place. Compare your calculations with those for Tenet Healthcare and LifePoint Hospitals reported in the chapter text. Which of the four companies maintains a higher receivables turnover?2. How does the receivables turnover ratio reflect the efficiency of management? Discuss factors that affect the receivables turnover ratio.

What will be an ideal response?

Requirement 1

Compared to Sturdy Medical, Strong Health has a higher receivables turnover ratio and a lower average collection period, which means it collects cash more quickly from its customers. The receivables turnover ratio and average collection period for Tenet Healthcare in the most recent year reported in the text are 5.6 times and 65.2 days, respectively. The receivables turnover ratio and average collection period for LifePoint Hospitals in the most recent year reported in the text are 4.3 times and 84.9 days, respectively. Strong Health has the most favorable (highest) receivables turnover ratio of the four companies.

Requirement 2

The receivables turnover ratio and average collection period provide an indication of management's ability to collect cash from customers in a timely manner. A high receivables turnover ratio suggests that managers are selling to customers that have the ability to pay their accounts in a timely manner. The more quickly a company can collect its receivables, the more quickly it can use that cash to generate even more cash by reinvesting in the business and generating additional sales. Factors that could affect the receivables turnover ratio would be managers failing to recognize the financial situation of lower-quality customers, being too aggressive in selling to customers on account, or encountering weak business conditions in the industry which would affect all companies.

You might also like to view...

The sales returns and allowances account is reported as a

A) contra-revenue account on the income statement. B) current liability on the balance sheet. C) contra-asset reducing accounts receivable on the balance sheet. D) selling expense on the income statement.

ACE has a defined benefit pension plan. ACE is preparing the December 31, 2015 financial statement disclosures related to the plan assets. It should disclose which of the following? I. Expected Return on Plan Assets II. Actual Return on Plan Assets ?

A) I B) II C) both I and II D) neither I nor II

Secondary data is readily available for very few applications

Indicate whether the statement is true or false

The board of directors of Lark Corporation declared a cash dividend of $3.50 per share on 57,000 shares of common stock on June 14, 20x5. The dividend is to be paid on July 15, 20x5, to shareholders of record on July 1, 20x5. The effects of the entry to record the declaration of the dividend on June 14, 20x5, are to

A) decrease stockholders' equity and increase liabilities. B) increase stockholders' equity and increase liabilities. C) decrease stockholders' equity and decrease assets. D) increase stockholders' equity and decrease assets.