Which of the following statements is correct?

a. Equity is more important than efficiency as a goal of the tax system.

b. Efficiency is more important than equity as a goal of the tax system.

c. Both equity and efficiency are important goals of the tax system.

d. Neither equity nor efficiency is an important goal of the tax system.

c

You might also like to view...

According to cost-benefit analysis, where safety is concerned

A) it is possible to not be safe enough. B) it is possible to be too safe. C) it is possible to be just safe enough. D) All of the above are possible.

The expenditure approach measures GDP by adding

A) compensation of employees, rental income, corporate profits, net interest, and proprietors' income. B) compensation of employees, rental income, corporate profits, net interest, proprietors' income, subsidies paid by the government, indirect taxes paid, and depreciation. C) compensation of employees, rental income, corporate profits, net interest, proprietors' income, indirect taxes paid, and depreciation and subtracting subsidies paid by the government. D) consumption expenditure, gross private domestic investment, net exports of goods and services, and government expenditure on goods and services.

Which one of the following would supply dollars to the foreign exchange market?

a. the sale of U.S. automobiles to a Mexican consumer b. the spending of British tourists in the United States c. the purchase of Canadian oil by a U.S. consumer d. the sale of a U.S. corporation to a Saudi Arabian investor

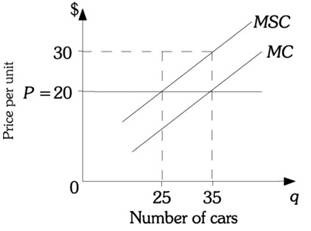

Refer to the information provided in Figure 16.2 below to answer the question(s) that follow. Figure 16.2Refer to Figure 16.2. The ________ imposed as a result of producing the efficient level of cars is $250.

Figure 16.2Refer to Figure 16.2. The ________ imposed as a result of producing the efficient level of cars is $250.

A. marginal social cost B. marginal social benefit C. total damage D. marginal private cost