Why does the government index income tax rates to inflation?

a. To avoid people paying less in taxes when there is inflation

b. To avoid people moving to a higher tax bracket when their purchasing power has increased

c. To avoid people paying less in taxes when their real purchasing power has not increased

d. To avoid people paying more in taxes when their real purchasing power has not increased

d. To avoid people paying more in taxes when their real purchasing power has not increased

You might also like to view...

The marginal propensity to consume plus the marginal propensity to save is always

A) equal to zero. B) greater than zero but less than one. C) equal to one. D) greater than one.

The joining of firms that are producing or selling a similar product is known as

A) a conglomerate merger. B) a horizontal merger. C) a vertical merger. D) economies to scale.

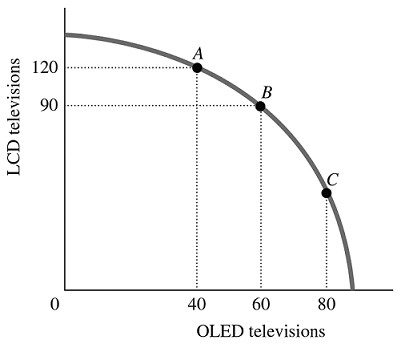

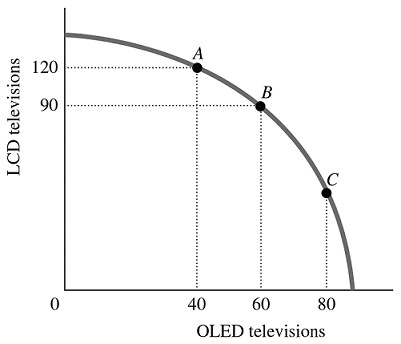

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

A. 120 LCD TVs that must be forgone to produce 20 additional OLED TVs. B. 30 LCD TVs that must be forgone to produce 40 additional OLED TVs. C. 20 OLED TVs that must be forgone to produce 30 additional LCD TVs. D. 40 OLED TVs that must be forgone to produce 120 additional LCD TVs.

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The best point for society would be

Figure 2.5Refer to Figure 2.5. The best point for society would be

A. either Point B or Point C, as the total amount being produced at either of these points is approximately the same. B. at any of the labeled points, as all of the points represent an efficient allocation of resources. C. Point C, as at this point there are approximately equal amounts of LCD and OLED televisions being produced. D. indeterminate from this information, as we don't have any information about the society's desires.