Recall the Application about French restaurants and the Value Added Tax (VAT) to answer the following question(s).Recall the Application. According to the Application, how much VAT did restaurants pay prior to 2003?

A. 20% VAT for restaurants with sit-down meals and 5% VAT for fastfood restaurants.

B. 25% VAT for all restaurants.

C. 20% VAT for fastfood restaurants and 5% VAT for restaurants with sit-down meals.

D. 5% for all restaurants.

Answer: A

You might also like to view...

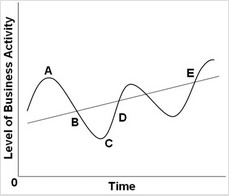

Use the following diagram to answer the next question. The straight line E drawn through the wavy lines would provide an estimate of the

The straight line E drawn through the wavy lines would provide an estimate of the

A. natural rate of unemployment. B. recovery trend. C. recession fluctuation. D. economic growth trend.

To say that a price ceiling is binding is to say that the price ceiling a. results in a surplus

b. is set above the equilibrium price. c. causes quantity demanded to exceed quantity supplied. d. All of the above are correct.

A country's financial account includes which of the following?

a. net investment income b. net transfers c. exports d. imports e. sales of assets to other countries

Refining capacity in the United States is

A. located almost entirely in Alaska. B. concentrated in the industrial mid-west. C. rather evenly spread out across the country. D. concentrated on the coasts.