The United States has imposed taxes on some imported goods that have been sold here by foreign countries at below their cost of production. These taxes

a. benefit the United States as a whole, because they generate revenue for the government. In addition, because the goods are priced below cost, the taxes do not harm domestic consumers.

b. benefit the United States as a whole, because they generate revenue for the government and increase producer surplus.

c. harm the United States as a whole, because they reduce consumer surplus by an amount that exceeds the gain in producer surplus and government revenue.

d. harm the United States as a whole, because they reduce producer surplus by an amount that exceeds the gain in consumer surplus and government revenue.

c

You might also like to view...

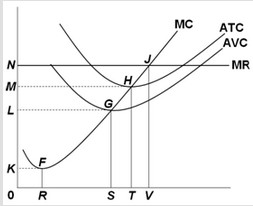

Use the following graph to answer the next question. The perfectly competitive firm's supply curve is the

The perfectly competitive firm's supply curve is the

A. MC curve at and above G. B. MC curve at and above F. C. MC curve at and above H. D. MC curve at and above J.

Full employment is not zero unemployment because

A) there are statistical errors when determining the unemployment rate that cannot be overcome. B) there is "normal" friction in the economy made up of those workers who are between jobs and those new entrants to the labor force. C) there are undocumented workers in the economy who are not counted by the Bureau of Labor Statistics. D) government workers are not counted in the labor force.

Which of the following is related to the concept of trade-off used in economics?

a. Paying tuition to attend college b. Paying a high price for a movie ticket on the first day of screening c. Not having enough information available to make a rational decision d. Giving up one good or activity in order to obtain some other good or activity e. Having your cake and eating it too

Which of the following is a determinant of investment?

a. Technological change b. Net exports c. Demographics d. Nominal GDP e. Population