The flypaper theory of tax incidence

a. ignores the indirect effects of taxes.

b. assumes that most taxes should be "stuck on " the rich.

c. says that once a tax has been imposed, there is little chance of it changing, so in essence people are stuck with it.

d. suggests that taxes are like flies because they are everywhere and will never go away.

a

You might also like to view...

There is no possibility of further widening of the European Union

Indicate whether the statement is true or false

The law of diminishing marginal utility explains why the demand curve is downward sloping. The law states that as you consume more of a good, the

a. total satisfaction you obtain from consuming the good falls b. added satisfaction you obtain from consuming an additional unit of the good increases at a diminishing rate c. marginal product increases at a diminishing rate d. satisfaction you obtain from each additional unit of the good you consume falls e. total satisfaction you obtain from each additional good you consume decreases at a diminishing rate

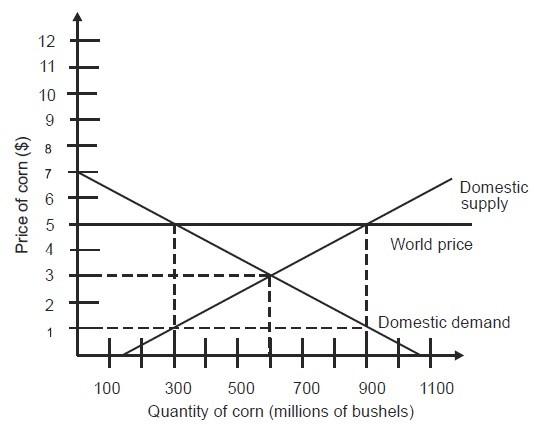

In an open economy, the quantity demanded of corn in the domestic market is ________.

A. 600 million bushels B. 900 million bushels C. 150 million bushels D. 300 million bushels

Suppose that the overnight interest rate falls to the lower bound and output is below potential output. A central bank could:

A. use its balance sheet to expand the monetary base. B. seek to reduce expectations of future policy rates. C. purchase securities of different maturities to affect their market prices and rates. D. all of the answers given are correct.