How do payments on a fixed-payment loan differ from a coupon bond?

What will be an ideal response?

Borrowers that use a coupon bond make interest payments at regular intervals and repay the face value when the bond reaches maturity. Those that borrow using a fixed-payment loan makes periodic payments that are equal and include both interest and principal.

You might also like to view...

Is a firm economically inefficient if it can cut its costs by producing less? Why or why not?

What will be an ideal response?

What is minimum efficient scale? What is likely to happen in the long run to firms that do not reach minimum efficient scale?

What will be an ideal response?

According to critics of new Keynesian economics, it is doubtful that

a. menu costs are very important in the real world. b. efficiency wage considerations play an important role in the real world. c. bargaining models are of significance in the real world. d. All of the above e. None of the above

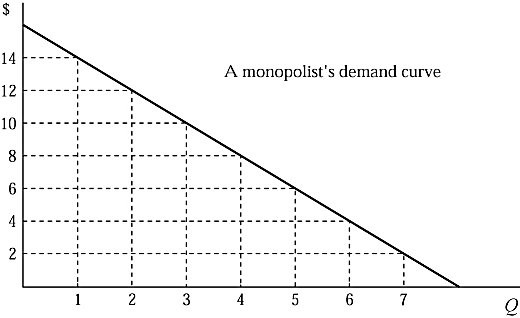

Figure 7.2 shows a monopolist's demand curve. Suppose that the marginal cost is $6 for all units and the current output level is 4 units. Then which of the following is true?

Figure 7.2 shows a monopolist's demand curve. Suppose that the marginal cost is $6 for all units and the current output level is 4 units. Then which of the following is true?

A. The marginal revenue is less than the marginal cost. B. The price is greater than the average total cost. C. The firm is producing the profit-maximizing level of output. D. All of these are correct.