Which of the following is an argument for tax cuts rather than government spending as a way to promote recovery from a recession?

a. Tax cuts are better suited to direct resources into projects that consumers value more highly than the resources required for their production.

b. 100 percent of a tax cut will stimulate aggregate demand, but this will not be the case for an increase in government expenditures.

c. Tax cuts will encourage rent seeking; increases in government spending will not.

d. Tax cuts will change the structure of aggregate demand more than increases in government spending.

A

You might also like to view...

The development of new technology typically

a. shifts the supply curve to the right b. reduces profits c. results in a downward movement along a supply curve d. increases costs of production e. shifts the demand curve to the right

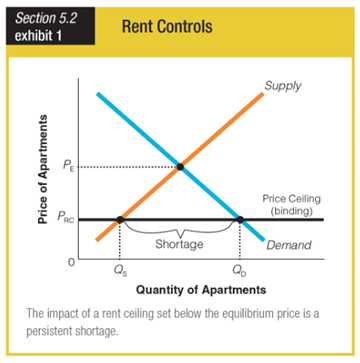

If many landlords convinced many tenants to leave their rent-control apartments, how would the graph most likely change?

a. PRC would increase.

b. PRC would decrease.

c. PE would decrease.

d. PE would increase.

Economic stagnation coupled with high inflation is commonly called:

A. stagflation. B. inflationary stagnation. C. stagnatory growth. D. inflagnation.

Answer the following statements true (T) or false (F)

1. In monopsony situations, a minimum wage might increase wage and employment levels. 2. Education is a form of human capital and it helps explain wage differentials. 3. Wage differentials are fully explained by differences in productivity and human capital among various workers. 4. There will be no principal-agent problem if a firm's owner (like a business consultant) does all the work of the firm.