The maximum amount of money that company shareholders can lose on their investment in the corporation is:

A. whatever percent of their wealth equals their percent of ownership.

B. whatever they paid for the shares in the company.

C. whatever the corporation loses each year times the percent of ownership in the company.

D. zero.

B. whatever they paid for the shares in the company.

You might also like to view...

On a graph we draw indifference curves to illustrate Steven's preferences for steak and broccoli. If two of Steven's indifference curves cross, then it cannot be the case that Steven

a. regards steak and broccoli as complements. b. spends more of his income on steak than on broccoli. c. likes steak and likes broccoli. d. always prefers more steak to less steak and more broccoli to less broccoli.

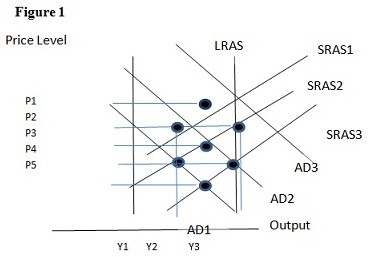

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.

A peach farmer must decide how many peaches to harvest for the world peach fair. He knows that there is a 25 percent chance that the world price will be $3, a 50 percent chance that it will be $3.50, and a 25 percent chance that it will be $4. His cost function is C(Q) = 0.05Q2. The farmer's maximum expected profit is:

A. 0. B. $122.50. C. $61.25. D. None of the answers are correct.

“If economic forecasting was a more exact science, the business cycle could be entirely corrected by fiscal measures.” Do you agree?

What will be an ideal response?