Determine which of the following independent projects should be selected for investment if a maximum of $240,000 is available and the MARR is 10% per year. Use the PW method to evaluate mutually exclusive bundles to perform your analysis.

FIGURE 1.png)

Develop bundles with less than $240,000 investment; select the one with the largest PW.

ANSWER.png)

PW1 = -100,000 + 50,000(P/A,10%,8)

= -100,000 + 50,000(5.3349)

= $166,746

PW2 = -125,000 + 24,000(P/A,10%,8)

= -125,000 + 24,000(5.3349)

= $3,038

PW3 = -120,000 + 75,000(P/A,10%,8)

= -120,000 + 75,000(5.3349)

= $280,118

PW4 = -220,000 + 39,000(P/A,10%,8)

= -220,000 + 39,000(5.3349)

= $-11,939

PW5 = -200,000 + 82,000(P/A,10%,8)

= -200,000 + 82,000(5.3349)

= $237,462

All other PW values are obtained by adding the respective PW for bundles 1 through 5.

Conclusion: Select PW = $446,864, which is bundle 7 (projects A and C) with $220,000 total investment.

You might also like to view...

Why is it important to use a helper when backing?

Systematic scientific research began in this country around the middle of the 1900s

Indicate whether the statement is true or false

At Runnymede in 1215, King John issued the Magna Carta, which

a. expanded his power over the magnates. b. limited his power over the church. c. was a groundbreaking constitutional charter. d. delimited what the king could demand of his people and powerful lords.

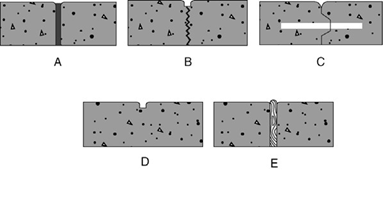

Which of the joint in the below figures is defined right?

A) tooled construction joint with expansion material

B) tooled dummy joint

C) decorative joint with a wood spacer

D) tooled control joint with a dowel