Firms account for leases using either the operating lease method or the capital (finance) lease method. Which of the following is not true?

a. The capital, or finance, lease method treats leases equivalent to installment purchases or sales, where the lessor borrows funds from the lessee to purchase the asset and the lessee recognizes profit at the time of sale.

b. The lessee records the leased asset and the lease liability on the balance sheet at the present value of the contractual cash flows at the time of signing the lease.

c. The lessee amortizes the leased asset, similar to recognizing depreciation on buildings and equipment.

d. The lessee recognizes interest expense on the lease liability, similar to recognizing interest expense on long-term notes or bonds.

e. The lessor records the signing of a capital lease the same as if the lessor sold the leased asset for an installment note receivable.

A

You might also like to view...

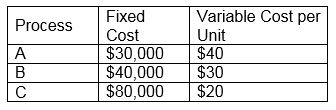

ABC Corporation would like to evaluate three production processes (A, B, and C) to accommodate the changes in demand for its products. The fixed and variable costs per unit are tabled here. Determine the process to be selected when the production volume is 500 units.

A. Process A

B. Process B

C. Process C

D. cannot be determined

Organizations change ______.

A. only when planned change is initiated B. only in response to an environmental threat C. only when change is unplanned D. all the time

Which of the following inventory management techniques gives the optimal amount of inventory to be purchased??

A. ?Economic order quantity model B. ?Lockbox system C. ?Payables system D. ?Outsourcing arrangement E. ?Quantity discount model

Outstanding checks, deposits in transit, and bank service charges are added to the beginning balance of the bank statement to determine the adjusted bank balance.

Answer the following statement true (T) or false (F)