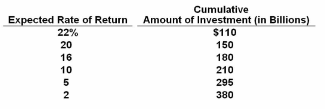

According to the cumulative investment table above:

A. $150 billion worth of investments have expected rates of return exactly equal to 20%

B. $150 billion worth of investments have expected rates of return of 20% or lower

C. $40 billion worth of investments have expected rates of return between 20% and 22%

D. $260 billion worth of investments have expected rates of return higher than 20%

C. $40 billion worth of investments have expected rates of return between 20% and 22%

You might also like to view...

For a risk-averse individual, as wealth increases, total utility ________ and marginal utility ________

A) increases; increases B) increases; decreases C) decreases; increases D) decreases; decreases

Which of the following is not associated with more inelastic demand?

a. a limited amount of time for consumers to respond to a price change b. availability of many close substitutes c. large percentage of income spent on the good in question d. Neither b. or c. is associated with more inelastic demand

The slope of the aggregate expenditure line is

a. less than zero b. less than 1.0 c. equal to 1.0 d. greater than 1.0 e. the same as the slope of the 45-degree line

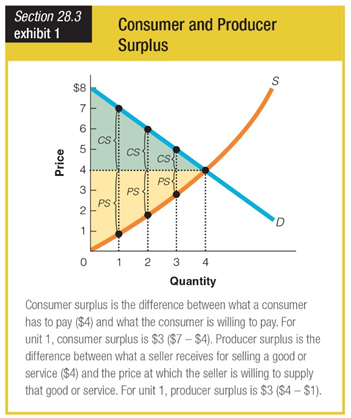

In Exhibit 1, what is the consumer surplus at a quantity of one unit when the price is $4?

a. $8

b. $7

c. $4

d. $3