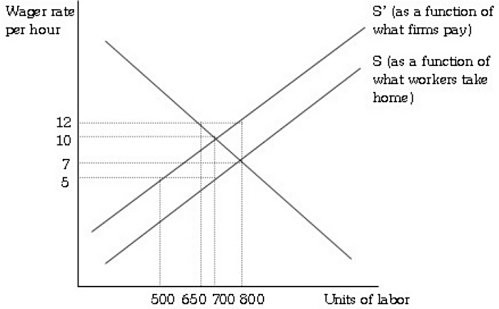

Refer to the information provided in Figure 19.1 below to answer the question(s) that follow.  Figure 19.1 Refer to Figure 19.1. The total tax collections from this payroll tax are

Figure 19.1 Refer to Figure 19.1. The total tax collections from this payroll tax are

A. $700.

B. $1,400.

C. $2,100.

D. $3,500.

Answer: D

You might also like to view...

Which of the following include the four basic resources supplied by households?

a. natural resources, labor, intelligence, capital b. money, labor, natural resources, entrepreneurial ability c. intellectual ability, physical ability, money, natural resources d. labor, capital, intelligence, entrepreneurial ability e. labor, natural resources, entrepreneurial ability, capital

Concerning tax rates and growth, which of the following is true?

A. Tax rates do not influence economic growth. B. Countries with high marginal tax rates have generally had higher rates of economic growth than those with low tax rates. C. Countries with low marginal tax rates have generally had higher rates of economic growth than those with high tax rates. D. Countries that impose high marginal tax rates at low-income thresholds generally have high rates of economic growth.

If the value of the domestic currency depreciates:

a. Aggregate demand falls and aggregate supply rises. b. Aggregate demand rises and aggregate supply rises. c. Aggregate demand rises and aggregate supply falls. d. Neither aggregate demand nor aggregate supply change. e. None of the above.

College students who increase their human capital by acquiring the skills required for certain occupations typically earn higher incomes than high school graduates. This is called:

A. the learning effect of a college education. B. the signaling effect of a college education. C. the discriminatory effect of a college education. D. None of these