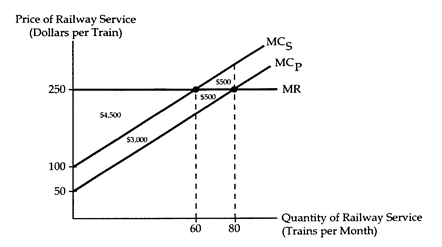

Railway engines create sparks, which sometimes set fire to crops planted near the tracks. A large number of farmers are affected, and transactions costs prevent the farmers and the railroad from negotiating bribes or side payments. The price of railway service is $250 per train, and each train causes $50 of crop damage. The accompanying diagram shows the relevant market for railway service.

(i) Suppose a Pigovian tax of $50 per train is imposed on the railroad. By how much will social gain increase?

(ii) Suppose that the farmers can move their crops away from the tracks at a cost of $2,400 per month. If the goal is to achieve economic efficiency, who should be made liable for the crop damage? What will be the resulting social gain?

(iii) Suppose that farmers still have the option of moving their crops as described in part ii. Also suppose that the railroad can install safety equipment that will prevent the engine sparks at a cost of $25 per train. If the goal is to achieve economic efficiency, who should be made liable for the crop damage? What will be the resulting social gain?

(i) Before the externality is internalized, social gain is $4,000. The Pigou tax causes the private marginal cost curve to coincide with the social marginal cost curve. The railroad runs 60 trains per month, and social gain rises to $4,500. The increase in social gain is $500.

(ii) Liability should be assigned to the farmers. The railroad will continue running 80 trains per month. Social gain rises to $8,000 - $2,400 or $5,600.

(iii) If the railroad is made liable, it will install the safety equipment. Private marginal costs increase by $25 per train, and the railroad runs 70 trains per month and earns $6,125 in producer's surplus. Social gain will thus be largest if the railroad is assigned liability.

You might also like to view...

The above figure shows the marginal social benefit and marginal social cost curves of doughnuts in the nation of Kaffenia. At Kaffenia's efficient quantity of doughnuts

A) total consumer surplus is zero. B) total producer surplus is zero. C) consumer surplus exceeds producer surplus by the greatest possible amount. D) the sum of consumer surplus and producer surplus is maximized.

If the firm’s marginal physical product is 8, and its handicrafts sell for $70, when a unit of labor costs $150, the firm is operating

A. short of an optimal input point. B. at the optimum input point. C. beyond the optimum input point. D. There isn’t enough information to determine if the input point is optimal.

Which of the following institutions is not subject to Federal Reserve's reserve requirements?

A) A state-chartered commercial bank B) A savings and loan association C) A money market mutual fund D) A credit union

Which of the following positions might be taken by the ruler of a nation practicing mercantilism?

a. support of the merchant marine sector b. support for the elimination of trade barriers such as tariffs c. support for the reduction of government holdings of specie d. discouragement of exploration and colonization e. All of the above.