In a proportional income tax system

A) marginal tax rates are the same regardless of the level of taxable income.

B) marginal tax rates increase as the level of taxable income increases.

C) marginal tax rates decline as the level of taxable income declines.

D) everyone pays the same dollar amount in taxes.

A

You might also like to view...

The price of non-work activities is:

A) zero. B) equal to the opportunity cost of those activities. C) less than the opportunity cost of those activities. D) greater than the opportunity cost of those activities.

A comprehensive retail sales tax is equivalent to a tax on income when _____

a. there is no deadweight loss from taxation b. there is at least some investment in the economy c. there is zero saving in the economy d. the economy is at full employment

Members of the Board of Governors

A. are appointed by the U.S. president, while presidents of the regional Federal Reserve Banks are appointed by those banks' boards of directors. B. are appointed by the regional Federal Reserve Banks' boards of directors while the presidents of the regional Federal Reserve Banks are appointed by the U.S. president. C. and the presidents of the regional Federal Reserve Banks are appointed by the U.S. president. D. and the presidents of the regional Federal Reserve Banks are appointed by the regional Federal Reserve Banks' boards of directors.

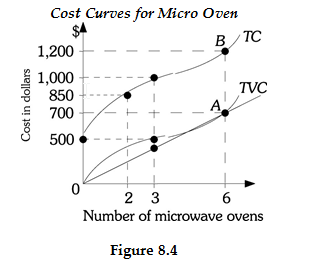

Refer to Figure 8.4. The marginal cost of the sixth microwave oven is A) $83.33. B) $116.67. C) $200. D) $1200.