Define imputed rental income. Is imputed rental income taxed? Based on your answer, discuss the tax code treatment of homeowners and renters on equity grounds

What will be an ideal response?

Imputed rental income is what an owner-occupied home could be rented for if not owner-occupied. Imputed rental income is not taxed under the current tax code. On equity grounds, the non-taxation of imputed rental income is wrong because it does not treat the owners of rental housing and the owners of owner-occupied houses equally, since those who rent houses have to pay taxes on their rental income.

You might also like to view...

Bobby spends $100 per month on pizza and CDs. His utility from these goods is shown in the table above. The price of a pizza is $10 and the price of a CD is $20. If Bobby maximizes utility from these goods, his total utility is ________ units

A) 705 B) 750 C) 770 D) 880

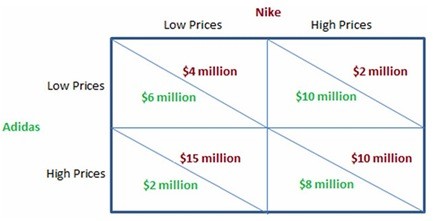

The outcome of the game in the figure show predicts that Nike will earn profits of:

The outcome of the game in the figure show predicts that Nike will earn profits of:

A. $10 million. B. $4 million. C. $15 million. D. $2 million.

In monopoly when abnormal profits are made:

a) The price set is greater than the marginal cost b) The price is less than the average cost c) The average revenue equals the marginal cost d) Revenue equals total cost

By 1937, when a new recession began in the midst of the Great Depression,

A. GDP had almost recovered to its 1929 level, but unemployment was still above the 1929 level. B. both GDP and unemployment had returned to near their 1929 levels. C. unemployment had almost fallen back to its 1929 level, but GDP had yet to recover to its 1929 level. D. neither GDP nor unemployment had returned to near their 1929 levels.