When the Fed reduces the money supply, it will cause a decrease in aggregate demand because:

A. real rates will rise, lowering business investment and consumer spending.

B. the dollar will depreciate on the foreign exchange market, leading to an increase in net exports.

C. lower interest rates will cause the value of assets (for example, stocks) to rise.

D. the national debt will increase, causing consumers to reduce their spending.

Answer: A

You might also like to view...

The above figure shows the production possibility frontier for a country. Suppose the country is producing at point D. What is the opportunity cost of increasing the production of rice to 15 tons?

A) 9 thousand bottles of wine B) 12 tons of rice C) 6 thousand bottles of wine D) 15 thousand bottles of wine E) Nothing, it is a free lunch.

Corrina just graduated from college, is unemployed, and looking for her first real job. This is an example of

A) frictional unemployment. B) structural unemployment. C) seasonal unemployment. D) cyclical unemployment.

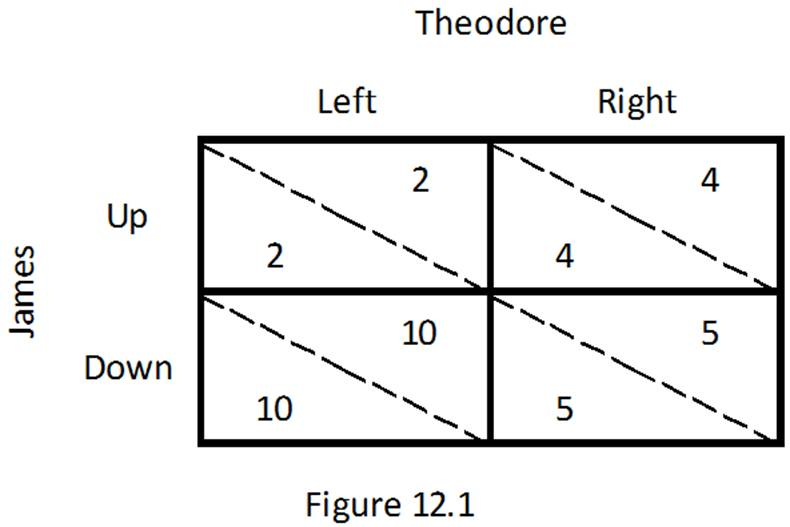

Refer to the game between James and Theodore depicted in Figure 12.1. Which of the following is true?

A. If James chooses Up, Theodore's best response is to choose Left.

B. If James chooses Down, Theodore's best response is to choose Right.

C. If Theodore chooses Left, James's best response is to choose Down.

D. If Theodore chooses Right, James's best response is to choose Up.

If Gross Domestic Product (GDP) equals $900 billion, gross private investment expenditures are $200 billion, exports equal imports, and government spending is $400 billion, then

A. consumption expenditures are $200 billion. B. we cannot determine what expenditures on consumption are without more information. C. consumption expenditures are $300 billion. D. spending on consumer durables must be $400 million.