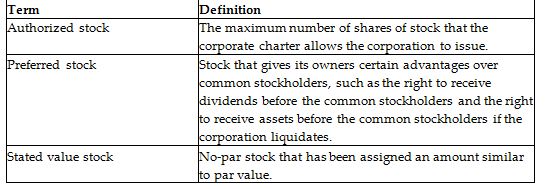

Define the following terms:

You might also like to view...

What traditional elements should be incorporated into packaging design and what are the new trends that impact packaging?

What will be an ideal response?

The data below is for Music Corporation for 2016. Accounts receivable—January 1, 2016 $236,000 Credit sales during 2016 820,000 Collections from credit customers during 2016 590,000 Customer accounts written off as uncollectible during 2016 8,000 Allowance for doubtful accounts—January 1, 2016 8,700 Estimated uncollectible accounts based on an aging analysis 9,600 Refer to the data for Music

Corporation. If the aging approach is used to estimate bad debts, what amount should be recorded as bad debt expense for 2016? a. $8,000 b. $8,100 c. $8,700 d. $8,900

Use the following information to answer the question below. When Calvert Corporation was formed on January 1, 2010, the corporate charter provided for 50,000 shares of $20 par value common stock. The following transactions were among those engaged in by the corporation during its first month of operation: 1 . The corporation issued 200 shares of stock to its lawyer in full payment of the $5,000

bill for assisting the company in drawing up its articles of incorporation and filing the proper papers with the state agency. 2 . The company issued 8,000 shares of stock at a price of $25 per share. 3 . The company issued 7,000 shares of stock in exchange for equipment that had a fair market value of $160,000. The entry to record transaction 1 would be: a. Start-up and Organization Costs 4,000 Common Stock 4,000 b. Start-up and Organization Costs 5,000 Common Stock 4,000 Additional Paid-in Capital 1,000 c. Start-up and Organization Costs 4,000 Additional Paid-in Capital 4,000 d. Start-up and Organization Costs 5,000 Common Stock 5,000

On April 1, 2018, Nunez Manufacturers purchases equipment for $100,000, paying $30,000 in cash and signing a 10-year mortgage for $70,000 at 8% annual interest

Prepare the journal entry to record the acquisition of the equipment. Omit explanation.