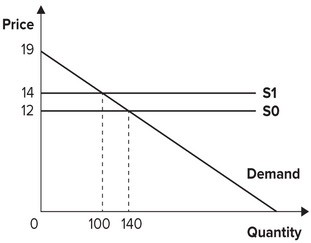

Refer to the graph shown. Initially, the market is in equilibrium with price equal to $12 and quantity equal to 140. As a result of a per-unit tax imposed by the government, the supply curve shifts from S0 to S1. The effect of the tax is to:

A. raise the price consumers pay from $12 to $14.

B. lower the price consumers pay from $14 to $12.

C. lower the price sellers keep after paying the tax from $14 to $12.

D. raise the price sellers keep after paying the tax from $12 to $14.

Answer: A

You might also like to view...

The more equal the income distribution in a society, the smaller the Gini coefficient

Indicate whether the statement is true or false

Marginal revenue product is

A) marginal physical product times marginal factor cost. B) marginal physical product times marginal revenue. C) average physical product times marginal revenue. D) marginal physical product times the wage rate.

When economic profits in a perfectly competitive industry are positive

A) new firms will be attracted to the industry, and economic profits will decline to zero. B) the industry is in equilibrium. C) firms will increase output to earn even higher profits. D) firms will increase prices while they have the opportunity.

If Y = $500 billion, autonomous consumption = $300 billion, and the marginal propensity to save = 0.20, then saving will equal:

a. ?$200 billion. b. $200 billion. c. ?$100 billion. d. $100 billion. e. $40 billion.