The following selected transactions took place during the current year for a company: Feb 25Declared a $2.50 per share cash dividend on 20,000 shares of common stock outstandingMar. 20Paid the cash dividends declared on Feb. 25.Dec 31Closed the $72,000 credit balance in Income Summary that reflects net income to Retained Earnings.(a) Prepare the journal entries for these transactions.(b) If Retained Earnings had a $155,000 credit balance on January 1, calculate its year-end balance as of December 31.

What will be an ideal response?

| (a) | Feb. 25 | Retained Earnings (20,000 shares * $2.5/share) | 50,000 | ? | ? |

| ? | ? | Common Dividend Payable. | ? | 50,000 | ? |

| ? | ? | ? | ? | ? | ? |

| ? | Mar. 20 | Common Dividend Payable | 50,000 | ? | ? |

| ? | ? | Cash | ? | 50,000 | ? |

| ? | ? | ? | ? | ? | ? |

| ? | Dec. 31 | Income Summary | 72,000 | ? | ? |

| ? | ? | Retained Earnings | ? | 72,000 | ? |

| ? | ? | ? | ? | ? | ? |

| (b) | ? | Retained earnings, January 1 | ? | $ 155,000 | ? |

| ? | ? | Plus net income | ? | 72,000 | ? |

| ? | ? | ? | ? | $227,000 | ? |

| ? | ? | Less dividends declared | ? | (50,000) | ? |

| ? | ? | Retained earnings, December 31 | ? | $177,000 | ? |

You might also like to view...

The presentation of the excess tax benefits related to stock options includes all of the following except:

A. Excess tax benefits are reflected in the cash from financing activities section of the statement of cash flows. B. Excess tax benefits are shown as a reduction of income tax expense. C. Presentation of excess tax benefits is guided by ASU 2016-09. D. Excess tax benefits must be shown in both the statement of shareholders' equity and the statement of cash flows.

As the marketing manager of Cominform Pvt. Ltd., a manufacturer of health drinks, you have selected 10 individuals who match the profile of your target customer, to participate in a discussion on changing lifestyle trends related to health

You have also hired a skilled moderator to facilitate the discussion and ensure that everyone participates and stays focused on the topic. The moderator provides questions and probes based on the "script" prepared by you. The discussions are also recorded for further analysis. Which of the following methods of acquiring primary data is being used in this case? A) observational research B) surveys C) behavioral data D) experiments E) focus groups

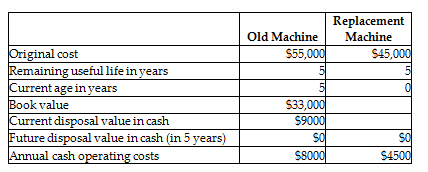

Which of the information provided in the table is irrelevant to the replacement decision?

Bradley Industries is considering replacing a machine that is presently used in its production process.

Which of the following is irrelevant to the replacement decision?

A) the sales price of the new machine

B) the original cost of the old machine

C) the current disposal value of the old machine

D) the annual cash operating costs for both machines

You have deposited $7,620 in a special account that has a guaranteed rate of return of 19% per year. If you are willing to completely exhaust the account, what is the maximum amount that you could withdraw at the end of each of the next 7 years? Select the amount below that is closest to your answer. (Ignore income taxes.)Refer to Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided.

A. $1,089 B. $2,219 C. $1,295 D. $2,056