Assume that the central bank purchases government securities in the open market. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and reserve-related (central bank) transactions in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period falls, and reserve-related (central bank) transactions remains the same.

b. The quantity of real loanable funds per time period falls, and reserve-related (central bank) transactions become more negative (or less positive).

c. The quantity of real loanable funds per time period rises, and reserve-related (central bank) transactions remains the same.

d. There is not enough information to determine what happens to these two macroeconomic variables.

e. The quantity of real loanable funds per time period and reserve-related (central bank) transactions remain the same.

.C

You might also like to view...

In the figure above, what is the efficient quantity of pesticide to produce?

A) 300 tons per month B) 240 tons per month C) 180 tons per month D) 360 tons per month

During the Black Plague, capital became worthless. What can explain this?

A) Capital's marginal product fell because there was less labor. B) Capitalists died off at a greater rate than the workers. C) Capital's marginal product increased but the marginal product of labor decreased. D) Workers forgot how to use the capital.

An outward shift of an economy's production possibilities curve is caused by:

a. an increase in capital. b. an increase in labor. c. an advance in technology. d. all of these.

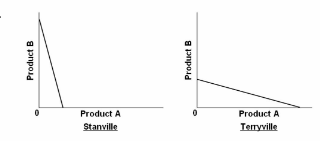

Refer to the graphs. Stanville has a comparative advantage in producing:

A. product A.

B. product B.

C. both product A and B.

D. neither product A nor B.