When different consumers pay different amounts of taxes, Ricardian equivalence may fail because

A) alternative ways of collecting the same tax revenue can affect the distribution of income.

B) consumers can become jealous of one another.

C) such differences in taxes create credit market imperfections.

D) higher taxes on more talented people may be politically popular.

A

You might also like to view...

According to the Coase theorem, which of the following are necessary for the efficient levels of pollution to be achieved? I. Property rights are defined. II. Transactions costs are low

A) I only B) II only C) both I and II D) neither I nor II

If a firm faces a downward-sloping demand curve, its marginal revenue is

a. less than its marginal cost b. greater than price c. less than price d. equal to price e. equal to its total revenue

The country known for its use of industrial policy

a. the United States b. Japan c. Hong Kong d. Singapore e. All of the above

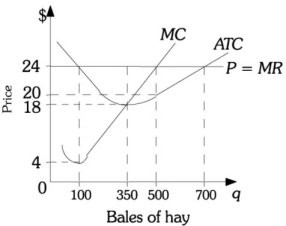

Refer to the information provided in Figure 8.9 below to answer the question(s) that follow.  Figure 8.9

Refer to Figure 8.9. If this farmer produces the profit-maximizing quantity when the market price is ________, her profit is $0.

Figure 8.9

Refer to Figure 8.9. If this farmer produces the profit-maximizing quantity when the market price is ________, her profit is $0.

A. $24 B. $20 C. $18 D. $4