In a certain city, the property tax collected for a home varies directly to the valuation of the property. The tax collected on a $105,000 home is $2,846 per year. What is the value of a home if the tax collected is $1,735 ?

What will be an ideal response?

$64,010

You might also like to view...

Solve the problem.Find the equation of the plane containing the line x = 4 - t, y = 2 + 2t, z = 6 - 3t, and the point (13, -16, 33).

A. x + y + z = -20 B. x + z = -20 C. x - y - z = -20 D. x - z = -20

Find the x-intercepts of the graph of the equation.y = x2 + 2x - 48

A. (8, 0), (6, 0) B. (8, 0), (-6, 0) C. (-8, 0), (6, 0) D. (-8, 0), (-6, 0)

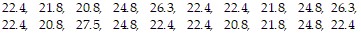

Find the mean, median, mode, and midrange for the given data. Round to the nearest tenth if necessary.

A. mean = 23.2, median = 22.4, mode = 22.4, midrange = 24.15 B. mean = 23.2, median = 22.4, mode = 22.4, midrange = 6.7 C. mean = 23.2, median = 24.8, mode = 22.4, midrange = 24.15 D. mean = 23.7, median = 22.4, mode = 27.5, midrange = 6.7

Solve the problem.What is the y-intercept of y = sec x?

A.

B. 1

C. 0

D. none